Research Insights

What Is Driving the Growth in Private Insurers' Payments for Hospital-Based Care?

Why This Study Is Important

Health care spending for privately insured individuals in the U.S. grew nearly 20 percent between 2007 and 2014 after adjusting for inflation. While previous research suggests that rising provider prices play a very important role in this spending growth, no prior work has examined the distinct contributions of hospital versus physician price growth. This study uses data on the actual prices allowed by several national insurers to document the pace of growth in hospital and physician prices for hospital-based care. Better understanding the sources of provider price growth can help to target public and private efforts to slow rising health spending for privately insured patients.

What This Study Found

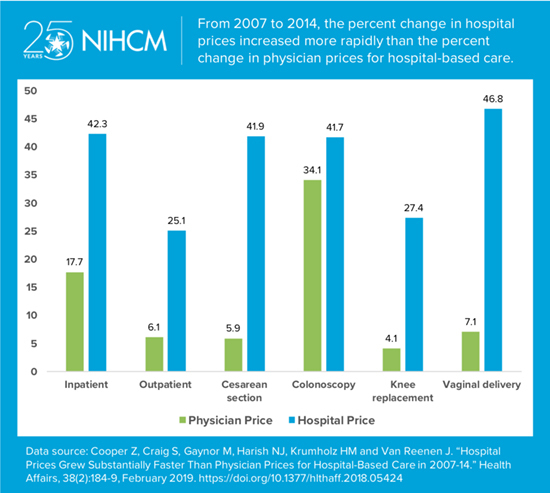

- Between 2007 and 2014, hospital prices grew much more quickly than did physician prices for care provided in the inpatient and hospital outpatient department settings. For all inpatient care, hospital prices grew by 42 percent compared to 18 percent for physician prices. For hospital outpatient care, the price growth rates were 25 percent for hospitals and 6 percent for physicians.

- The same pattern was observed for four common hospital-based procedures. For Cesarean-sections, vaginal deliveries, and knee replacements, hospital prices grew approximately 6.5 to 7 times more quickly than physician prices. The differential was less pronounced for colonoscopies, but hospital price growth still outpaced physician price growth for this procedure.

- With hospital prices growing more quickly and accounting for a larger share of total spending to begin with, this sector was responsible for the vast majority of the growth in the total price of care for hospital-based care. Depending on the service, hospital price growth accounted for 77 to 97 percent of the growth in the total price for the care.

What These Findings Mean

The much faster growth in hospital prices suggests that efforts to reduce spending on the privately insured should focus more intensely on the rising hospital prices rather than physician prices. Hospitals appear to have greater bargaining leverage than physicians vis-à-vis private insurers, especially in the wake of ongoing consolidation in the hospital sector. Much more active antitrust review and enforcement should be considered as a top policy response to this growing consolidation. Policymakers may also want to introduce hospital rate regulation, particularly in markets that are already highly concentrated. Additionally, private payers should seek ways to steer patients to the most efficient hospitals, such as by adopting reference pricing and incentivizing physicians to refer their patients to those facilities.

More About This Study

This study used claims for patients with employer-sponsored coverage from three large national insurers to examine changes in the total prices actually paid by insurers and patients to physicians and hospitals for hospital-based care. Prices were examined for all inpatient care, all hospital-based outpatient department care, and four high-volume services performed in these settings. The prices reflected all facility and physician claims generated throughout an admission for inpatient care or on the day of service for outpatient care. Analyses were limited to patients with no significant comorbidities. National average prices were computed for each year controlling for the complexity of care delivered and for annual differences in how enrolled patients were distributed across higher- and lower-cost hospital referral regions.

Cooper Z, Craig S, Gaynor M, Harish NJ, Krumholz HM and Van Reenen J. “Hospital Prices Grew Substantially Faster Than Physician Prices for Hospital-Based Care in 2007-14.” Health Affairs, 38(2):184-9, February 2019.

More Related Content

See More on: Cost & Quality | Provider Consolidation