December 02, 2020

Improving Risk Adjustment Methods May Create More Robust Health Insurance Exchanges - New Research Insights

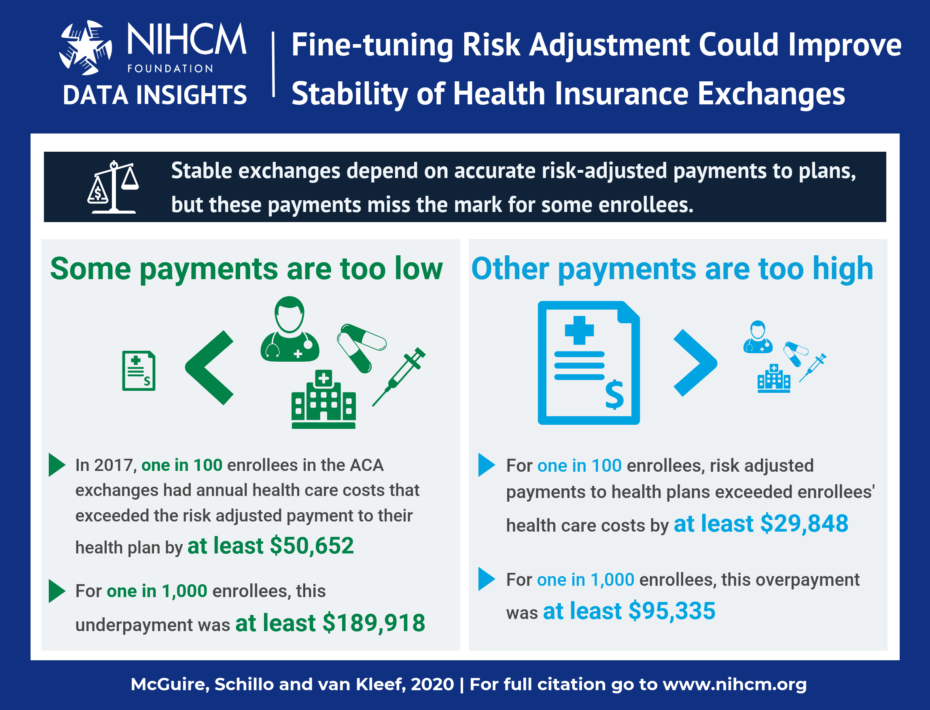

When the Biden administration takes on the issue of health care in 2021, there will likely be a renewed interest in strengthening the Affordable Care Act’s health insurance exchanges. A new study conducted by Harvard professor Thomas G. McGuire, PhD, and his colleagues in the Netherlands and Germany reveals a need to fine-tune the current methods of adjusting payments to insurers so they more accurately reflect the risk represented by individual enrollees. Existing methods sometimes greatly underpay or overpay insurers, which may affect their willingness to participate in the exchanges.

Here are highlights from the research:

- Reduced Market Efficiency: There is high year-to-year persistence among individual enrollees who are either highly under- or overpaid. This can lead to selection problems and have a negative impact on the market.

- Focused Adjustment is Indicated: Improvements in risk adjusted payments can be achieved by focusing on the most dramatically underpaid enrollees, as a large part of the payment inaccuracies involve this group.

This study develops an innovative reinsurance system for the most underpaid enrollees and shows it significantly improves payment accuracy. Ensuring that the risk adjusted payments the government provides to insurers are as accurate as possible can encourage insurers to remain engaged in health insurance exchanges, which means health care consumers will have a broader range of choices.