Expert Voices

Federal Antitrust Enforcement in Health Care

By: David Dranove, PhD, Walter McNerney Distinguished Professor of Health Industry Management & Director of the Health Enterprise Management Program, Kellogg Graduate School of Management, Northwestern University

In previous Expert Voices essays, William Vogt, Austin Frakt and James Robinson discussed consolidation in hospital markets and cited a large and growing literature that finds a direct correlation between consolidation and hospital prices, with at best mixed evidence of improved quality. All three essayists suggested that the Federal Trade Commission must do more to limit anticompetitive consolidations.

In fact, the FTC and the Department of Justice successfully challenged numerous hospital mergers through the early 1990s until a string of losses in key court cases in the mid-1990s led them to suspend prospective merger challenges for about a decade while they regrouped. In this essay I describe how academic economists helped to reverse the tide of antitrust litigation losses by developing more precise merger analytic tools that emphasize the importance of negotiating strength between merging providers and payers. I also take a look forward at the new frontier of antitrust enforcement that is evolving with the rise of vertically integrated delivery systems.

A Brief Antitrust Primer

Merger analysis may be retrospective or prospective. In retrospective analyses, economic experts may assess the merger’s impact on prices and other factors after the merger has occurred. The most prominent such case in the hospital arena involved Evanston Northwestern Healthcare (ENH), formed by a 2000 merger between two hospitals in Chicago’s North Shore suburbs. In its 2004 challenge to this merger, the FTC showed that post-merger prices increased more quickly at ENH than at peer hospitals.

Most mergers are challenged before the merger has been consummated. In these prospective cases, economists must forecast merger effects, typically by (1) identifying relevant product and geographic markets in which competition occurs, (2) calculating market shares for all market participants, (3) computing the Herfindahl-Hirschman index (HHI) measuring market concentration, and (4) predicting the change in the HHI expected from the merger.

The horizontal merger guidelines established by the FTC and DOJ include thresholds for the market HHI and the change in HHI that may be used to identify potentially problematic mergers. The courts also may consider other evidence, including the potential for entry by new competitors and whether the merger will have pro-competitive benefits (e.g., by improving quality). In practice, courts place considerable weight on the market concentration evidence. Merging hospitals are more likely to prevail if they can convince the court that the market is broad, so that both the pre-merger HHI and the predicted increase in the HHI are small.

The 1990s: What Went Wrong?

During the FTC losing streak, nearly every case turned on the question of geographic market definition. Ironically, it was the FTC’s victory in the 1989 Rockford, Illinois hospital merger case that set the stage for its later losses. Seeking to bring empirical rigor to market definition, the FTC expert used an approach initially proposed by Ken Elzinga and Tom Hogarty to study coal markets.1 The so-called EH methodology begins with a proposed geographic market then uses historical data to determine whether the shares of customers flowing into and out of the area are lower than a predetermined threshold (the low inflow and outflow criteria). As needed, the proposed market is expanded incrementally until the flows of customers crossing the border fall below the threshold. Thus, lower target thresholds yield broader, more encompassing markets. Applied to hospitals, it was reasoned that if many patients have been willing to travel outside of the market then merging hospitals’ ability to raise prices would be checked by an exodus of price-sensitive patients.

EH specified thresholds ranging from 10 to 25 percent and the chosen target affects the market scope and HHI calculations. In the Rockford case, a 10 percent threshold implied a broad market that included the Chicago suburbs in which the merger would not have caused a significant increase in concentration. But with a 25 percent threshold the market was just the Greater Rockford area, and the merger was predicted to increase concentration significantly. Accepting the EH methodology and 25 percent threshold, the court blocked the merger.

In subsequent cases, courts embraced EH analyses but sided with defendants in accepting lower thresholds than proposed by the government. The courts approved merger after merger, including several that seemed to create a duopoly and one that seemed to lead to monopoly. Facing a wall, in 1999 the FTC took a respite from prospective hospital merger enforcement.

Academic Economists to the Rescue

During this time, economists were identifying serious flaws with EH analysis, noting its lack of a theoretical foundation mapping specific flow percentages to specific price changes and the sensitivity of the market determination to even small variations in how the methodology is applied. Most critically, however, EH has proven to be a poor tool for predicting merger outcomes.2 Several studies identified mergers that survived EH analyses yet led to substantial price increases, and disparaging reports by the Robert Wood Johnson Foundation and the FTC and DOJ concluded that a new approach was needed.3,4

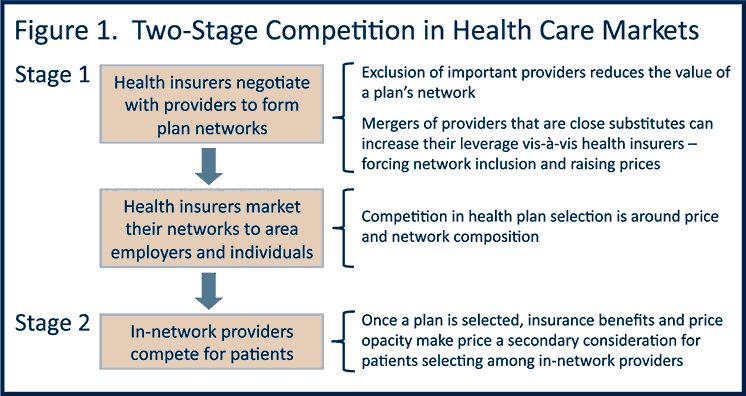

The search for new analytic frameworks did not last long. In the early 2000s, three teams of economists (of which I was a part) published closely related papers presenting “structural” models of hospital competition in which statistical analyses are guided by key institutional details, particularly the special role of selective contracting (Figure 1).5,6,7 In her expert report for the ENH merger, Deborah Haas-Wilson distilled the structural models into a simple two-stage framework. In Stage One, hospitals and insurers bargain over network inclusion, prices and other contractual terms, then policies are sold. In Stage Two, enrolled patients choose among in-network providers, and price is a secondary consideration. In other words, the price impacts of a merger depend on how the merger affects the hospitals’ relative market power vis-à-vis insurers.

The study that I coauthored added rigor to this framework.6 We showed that a hospital with a unique location, or offering unique services, has more bargaining leverage than a hospital facing many nearby competitors offering similar services. Two neighboring hospitals may gain leverage through merger, especially if there are no nearby competitors. In the ENH case, health insurers testified that they needed to contract with hospitals on Chicago’s North Shore to offer a viable provider network and that the ENH merger left them little choice but to accede to demands for higher prices. Importantly, too, Ken Elzinga testified that Stage One competition makes EH inappropriate for assessing hospital mergers. Those arguments won the day.

In subsequent cases, the FTC used this structural approach to predict the price effects of pending mergers. Economists for hospitals continued to rely on EH and related approaches. Thus far, the FTC has prevailed in court decisions or the parties have abandoned their merger plans.

What Is Next?

Courts usually decide merger cases under a “rule of reason” that weighs potential increases in market power against potential efficiencies. In most cases, courts have cast a skeptical eye on claimed efficiencies from horizontal mergers. As attention shifts to the growth of accountable care organizations (ACOs) and other powerful vertically integrated systems, providers may renew efficiency claims and regain momentum in the courts.

Currently, Attorneys General in Massachusetts and California, respectively, are investigating concerns that Partners Healthcare and Sutter Health dominate their local markets and insurers feel unable to resist their demands for greater reimbursements. These systems have grown incrementally, acquiring a physician group here and a surgery center there, rather than through large-scale acquisitions that are easier to block in court. They tout better clinical integration and lower costs and deny that these vertical acquisitions confer market power.

A similar acquisition recently challenged by the FTC provided the first real test of how courts will weigh efficiency claims from vertical integration against any anti-competitive consequences of horizontal mergers. St. Luke’s Healthcare, a multi-hospital system serving Boise, Idaho and surrounding areas, is the second largest provider of primary care physician services in Nampa, located some 30 minutes from Boise. St. Luke’s sought to acquire Nampa’s largest primary care group, the Saltzer Medical Group. This horizontal merger of Nampa-based physicians was part of St. Luke’s strategy of creating the region’s largest vertically integrated delivery system. In the trial last fall, I testified for the FTC that the evidence for efficiencies in integrated delivery systems is mixed and that dominant systems, once formed, are hard to undo. I further argued that many types of organizations are creating ACOs and that hospitals need not acquire physician practices to achieve clinical integration.

On January 24, 2014 the U.S. District Court for Idaho ruled for the immediate dissolution of the St. Luke’s/Saltzer merger. In what may be seen as a complete victory for the FTC, the court concluded that the merger would enhance St. Luke’s bargaining power, leading to higher prices, and that there were less restrictive ways for St. Luke’s to improve quality and control costs. Future developments in antitrust enforcement will bear watching as the delivery system continues to evolve.

- Elzinga K, Hogarty T. “The Problem of Geographic Market Delineation in Antimerger Suits.” The Antitrust Bulletin, pp. 45-81, March 1974.

- Capps C, Dranove D, Greenstein S, Satterthwaite M. “Antitrust Policy and Hospital Mergers: Recom-mendations for a New Approach.” The Antitrust Bulletin, pp. 677-714, Winter 2002.

- Vogt WB, Town R. “How has Hospital Consolidation Affected the Price and Quality of Hospital Care?” Robert Wood Johnson Foundation, Research Synthesis Report 9, 2006.

- Improving Health Care: A Dose of Competition. Federal Trade Commission and the U.S. Department of Justice, 2004.

- Town R, Vistnes G. “Hospital Competition in HMO Networks.” J Health Econ 20(5):733-53, 2001.

- Capps C, Dranove D, Satterthwaite M. “Competition and Market Power in Option Demand Markets,” RAND J Econ, 34(4):737-63, 2003.

- Gaynor M, Vogt WB. “Competition Among Hospitals,” RAND J Econ 34(4):764-85, 2003.

More Related Content

See More on: Cost & Quality