Expert Voices

Small Business Health Insurance Coverage Under the ACA

By: Sabrina Corlette, JD, Senior Research Fellow and Project Director, Center on Health Insurance Reforms, Georgetown University

Small business owners have long struggled to provide health insurance to their workers, facing high and often volatile premiums relative to large businesses, a lack of market power for negotiating premiums, and high administrative costs associated with covering a small number of workers. In addition, minimum participation requirements used to safeguard against adverse selection mean that small employers often can offer only one plan and must cover a hefty portion of employees’ premiums in order to get enough employees to enroll. These pressures have contributed to a steady decline in the number of small businesses offering coverage and left their employees more likely to be uninsured. Furthermore, even small business workers who received insurance have historically had less generous coverage, with much higher deductibles and lower employer contributions for dependent coverage.1

The ACA and the Small Group Market

While much of the focus of the Patient Protection and Affordable Care Act (ACA) was on addressing a dysfunctional health insurance market for individuals, policymakers also wanted to help more small businesses offer adequate and affordable coverage. Key pillars included revised insurance rules and new marketplaces to facilitate shopping.

Insurance Reforms

The ACA established a set of national minimum standards that took aim at the most glaring problems in the small group market. Consistent with the changes effected for the individual market, the small group reforms prohibited health underwriting, required minimum essential health benefits and first-dollar coverage of approved preventive services, ended benefit limits and exclusions based on pre-existing conditions, and capped enrollees’ annual out-of-pocket liability. In addition, insurers offering products in the small group market are now required to set rates using a single risk pool that includes all enrollees across their small group plans in the state. Finally, small employers can avoid having to meet minimum participation thresholds if they obtain coverage during a November-to-December open enrollment period.

To date, only firms with 50 or fewer workers have been affected by these provisions. Although the ACA allowed states to expand the small group market to include firms with 51 to 100 workers for 2014 and 2015, no state elected to do so. This expansion is set to be enacted nationwide in 2016, however, newly subjecting these mid-size firms to the ACA’s rating and benefit reforms at the same time they must also begin complying with the ACA’s employer mandate. Concerns about the potential for premium increases, adverse selection and market destabilization resulting from this expansion have prompted a rare bipartisan effort in Congress to repeal this provision of the ACA and leave the market definition decision to the states.

SHOP Exchanges and Tax Credits

The ACA also created the Small Business Health Options Program (SHOP) exchanges, or marketplaces, where small businesses can shop for health insurance. Responding to small business owners’ concerns about their inability to give employees a choice of plans, SHOPs are designed to provide an “employee choice” option whereby employers can set a contribution level and let each employee select his or her preferred option from a range of plans.

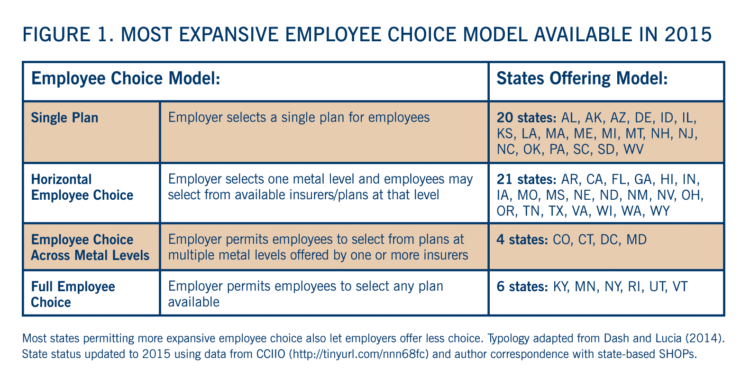

Each state has a SHOP, some run by the state but the majority operated by the federal government. With few exceptions, the SHOPs were slow to get off the ground and enrollment has been low so far. In 2014, only a minority of states offered online enrollment and fewer still prioritized the SHOP in their marketing and outreach campaigns.2 In addition, mandatory nationwide implementation of employee choice was delayed until 2016, resulting in uneven rollout of this option across states. As of 2015, 31 states are providing some form of employee choice (Figure 1).

The ACA also provides premium tax credits to help make insurance more affordable for very small employers with moderate-income workers. The credits are available only to businesses enrolling through the SHOP, and then only for two years. Few small businesses have made use of these credits, likely due to narrow and complex eligibility requirements and relatively low credit amounts.3,4

Everybody Into the Pool? (Maybe Not)

Under the ACA reforms, many small employers — and their employees — will benefit from the new rating and benefit standards and cost-sharing protections. Others, particularly those with young and healthy workers, may face premium increases as they are brought into a single risk pool that includes older and sicker workers. Several alternative coverage options currently enable such employers to circumvent the single risk pool, leaving the higher-risk people who remain in the pool to face higher premiums and threatening the long-term viability of the small group market.

Non-ACA Compliant Plans

Many small group plans are exempt from the ACA market reforms. Some are considered “grandfathered” because they were in existence before the ACA was passed and have not made significant changes to benefits. Others were granted a reprieve under a transitional rule that allows states to permit small employers (and individuals) to remain in the plans they had before reforms took effect in 2014 – the so-called “grandmothered” plans. The great majority of states have opted to permit renewals of transitional plans until October 2016 (extending coverage into 2017),5 and anecdotal evidence suggests that many small employers in these states have remained on their pre-ACA plans.6 Most states have also announced plans to permit mid-size group plans to take advantage of the transitional policy when the small group market is expanded.

Self-Funding

Small and, soon, mid-size employers with healthy groups may also find it tempting to self-fund coverage, meaning that they bear the risk of employees’ medical claims. Such a move exempts them from many of the ACA’s rating and benefit reforms and effectively removes them from the insurance risk pool. Self-funding employers can purchase a reinsurance or stop-loss policy to protect against the significant financial risk of unexpectedly large claims. Increasingly, these policies are incorporating very low thresholds above which claims are covered; such policies can thus mimic traditional health insurance while avoiding health insurance regulations. Researchers have projected that use of low-threshold stop-loss policies can lead to large premium increases for employers remaining in the regulated small group market,7 undermining market stability.

While there is limited evidence that current small employers have been transitioning to self-funding in significant numbers at this time, the propensity to self-fund may increase as the small group market expands.8 Not only would mid-size employers be somewhat better able to accept the financial risk, those with young or healthy workforces may see self-funding as a way to avoid premium increases associated with the ACA’s expanded benefits and pricing based on a single risk pool. As more mid-sized firms choose to self-fund, adverse selection could spread across the entire small group market, putting additional upward pressure on premiums. Self-funding is also likely to be attractive to small group employers of all sizes as they move off of transitional plans over the next couple of years, making this a trend to watch.

The Outlook for the Future

Despite a decade or more of declining offer rates, many small employers still find it important to provide high quality health coverage for their workers. The ACA insurance reforms, SHOP exchanges, and premium tax credits offer them new options for doing so, although the ultimate impact of these policies remains to be seen. With the exception of Vermont and Washington DC, small employers can bypass the SHOP and continue to purchase coverage directly from an insurer, and a growing number of private exchanges are also coming online to serve this market.

But the long-term viability of the small group market needs to be closely monitored. With the continued enrollment in transitional plans, it will be a few more years before the effects of the ACA are fully felt. Additionally, the upcoming expansion of the market to include firms with 51 to 100 workers is likely to have a destabilizing impact.

A second change set for next year whose impact bears monitoring will be the nationwide availability of employee choice within the SHOP exchanges. The exchanges will need to balance the goals of attracting employers to the SHOP and giving small business workers more say in selecting their own health coverage with the risk of adverse selection posed by the more expansive models of employee choice.9

It will also be important to watch whether small employers now offering coverage begin to drop coverage and encourage their workers to enroll in the individual health insurance exchanges instead. Employers with 50 or fewer workers face no penalty for doing so and their lower-income workers might be better off accessing premium subsidies in the individual market. There is early anecdotal evidence that some small employers are doing exactly this,10 and this trend would be accelerated if the small group market begins to experience significant adverse selection. Additionally, legislation now pending in Congress would permit small employers to contribute to an employee’s health reimbursement account and send the employee to the individual exchange to purchase stand-alone coverage, potentially making this option more attractive.

- Blavin F, Garrett B, Blumberg L, et al. “Monitoring the Impact of the Affordable Care Act on Small Employers: Literature Review.” The Urban Institute. October 2014.

- Blumberg L, Rifkin S. “Early 2014 Stakeholder Experiences with Small-Business Marketplaces in Eight States.” The Urban Institute. August 2014.

- Ibid.

- U.S. Government Accountability Office. “Small Business Health Insurance Exchanges: Low Initial Enrollment Likely Due to Multiple, Evolving Factors.” GAO Report 15-58. November 2014.

- Lucia K, Corlette S, Williams A. “The Extended ‘Fix’ for Canceled Health Insurance Policies: Latest State Action.” The Commonwealth Fund Blog. November 21, 2014.

- U.S. Government Accountability Office. “Small Business Health Insurance Exchanges: Low Initial Enrollment Likely Due to Multiple, Evolving Factors.” GAO Report 15-58. November 2014.

- Buettgens M, Blumberg L. “Small Firm Self-Insurance Under the Affordable Care Act.” The Commonwealth Fund. November 2012.

- American Academy of Actuaries. “Potential Implications of the Small Group Definition Expanding to Employers with 51-100 Employees.” Issue Brief. March 2015.

- Dash S, Lucia K. “Employee Choice.” Health Policy Brief. Health Affairs: September 2014.

- Abelson R. “Providing Health Insurance Still a Struggle for Small Business.”The New York Times, November 4, 2014.

More Related Content

See More on: Health Care Coverage